Categories

- All Categories

- Business

- Technology

- Health

- Other

- Sports

- Arts & Culture

- Family & Home

- Shopping

- Entertainment

- Personal

Tags

-

#Data Analytics

#kids scooter

#Cosmetics

#hearing aids

#Power Tools

#Patient Engagement Solutions Market

#Packaged Salad Market

#outdoor furniture

#Roofing Materials

#guitar

#DATA LAKE Market

#Transplant Diagnostics Market

#Minimally Invasive Surgical Instruments Market

#Vegan Cosmetics Market

#Next Generation Sequencing Market

#Personal Mobility Devices Market Size

#Personal Mobility Devices Market

#Fragrance

#nuts

#Automotive Collision Repair Market

#3D Printing

#Iron Casting Market

#Data Lake

#3D Printing Filament Market

#Semi-Trailer

#bioplastics market

#bioplastics market share

#bioplastics market size

#bioplastics market growth

#Mining Equipment Market

#Aluminum Die Casting Market

#Data Fabric Market

#1

#Hyper-Converged Infrastructure Market Size

#Gas Chromatography Market

#Dental 3D Printing Market

#Electric Ship Market

#Electric Ship Market Size

#Electric Ship Market Share

#Automotive Robotics Market

#Collagen Market

#Yacht Market

#Yacht Market Size

#Yacht Market Share

#Metalworking Fluids Market

#Hydrogen Energy Storage Market

#Hydrogen Energy Storage Market Size

#Hydrogen Energy Storage Market Share

#Vegan Cosmetics

#Everything as a Service

#Everything as a Service market

#Internet of Things

#pipette tips

#ceramic sanitary ware

#Metal Forging Market

#Advanced Ceramics Market

#Gaming Market

#Hair Color

#Automotive Transmission Market

#Membrane Bioreactor Market

#Membrane bioreactor

#Infection Control Market Size

#Collectibles

#Companion Diagnostics Market

#Biosimilars Market

#Biosimilars Market analysis

#Waterproofing membranes

#Self-Healing Concrete Market Size

#microneedling

#Aluminum Die Casting

#Internet of Things Market

#Internet of Things Market Size

#Internet of Things Market Share

#Internet of Things Market Growth

#Internet of Things Market Trends

#Internet of Things Market Analysis

#salmon fish

#Streaming Analytics Market

#Small Cell 5G Network Market

#Solar Tracker Market

#Electric Ship Market Growth

#Electric Ship Market Trends

#Minimally Invasive Surgical Instruments Market Size

#Minimally Invasive Surgical Instruments Market Share

#Minimally Invasive Surgical Instruments Market Growth

#Structured Cabling market

#5G Fixed Wireless Access Market

#Veterinary Telehealth Market

#Cannabis Pharmaceuticals Market

#Industrial Air Filtration Market

#Powder Coatings Market

#Cloud Gaming Market

#Corrugated Board Market Growth

#Surgical Sutures Market

#Satellite Communication Market

#Color Cosmetics Market Size

#Queue Management System Market Growth

#Hearing Aids Market

#Data Fabric Market Size

#Electric Ship

#Infection Control Market

#yacht

#Surgical Sutures Market Size

#Self-Healing Concrete Market

#Food Waste Management Market

#Cheese Market

#Aluminum Die Casting Market Size

#Aluminum Die Casting Market Share

#custom printing

#Power Tools Market Size

#Generative AI in Music Market

#Generative AI in Music Market Size

#Generative AI in Music Market Share

#Advanced Ceramics Market Size

#Outdoor Furniture Market

#Digital Identity Solutions Market

#hosiery

#Metalworking Fluids Market Share

#Metalworking Fluids Market Size

#Metalworking Fluids Market Growth

#Metalworking Fluids Market Trends

#Spa Services

#Power Tools Market

#Roofing Materials Market

#Roofing Materials Market Analysis

#Expanded Polystyrene Market

#Advanced Ceramics

#Queue Management System Market Trends

#Reclaimed Lumber

#Reclaimed Lumber Market

#Color Cosmetics Market

#hr software

#3D Printing Market

#Data Lake Market Size

#Data Lake Market Share

#Data Lake Market Growth

#Nitric Acid Market

#Nitric Acid

#Bioplastics

#Advanced Ceramics Market Growth

#softgel capsules

#U.S. Active Adult (55+) Community Market

#Softgel Capsules Market

#Antimicrobial Medical Textiles

#Antimicrobial Medical Textiles Market

#Antimicrobial Medical Textiles Market Size

#Antimicrobial Medical Textiles Market Share

#Antimicrobial Medical Textiles Market Growth

#Antimicrobial Medical Textiles Market Trends

#Antimicrobial Medical Textiles Market Analysis

#Antimicrobial Medical Textiles Market Forecasts

#Bioceramics

#Bioceramics Market

#Bioceramics Market Size

#Bioceramics Market Share

#Bioceramics Market Growth

#Bioceramics Market Trends

#Bioceramics Market Analysis

#Bioceramics Market Forecasts

#Hyper-converged Infrastructure

#Hyper-converged Infrastructure Market

#Hyper-converged Infrastructure Market Share

#Hyper-converged Infrastructure Market Growth

#Hyper-converged Infrastructure Market Trends

#Hyper-converged Infrastructure Market Analysis

#Hyper-converged Infrastructure Market Forecasts

#Myelodysplastic Syndrome Drugs

#Myelodysplastic Syndrome Drugs Market

#Myelodysplastic Syndrome Drugs Market Size

#Myelodysplastic Syndrome Drugs Market Share

#Myelodysplastic Syndrome Drugs Market Growth

#Myelodysplastic Syndrome Drugs Market Trends

#Myelodysplastic Syndrome Drugs Market Analysis

#Myelodysplastic Syndrome Drugs Market Forecasts

#Radiation Detection

#Monitoring And Safety

#Monitoring And Safety Market

#Monitoring And Safety Market Size

#Monitoring And Safety Market Share

#Monitoring And Safety Market Growth

#Monitoring And Safety Market Trends

#Monitoring And Safety Market Analysis

#Monitoring And Safety Market Forecasts

#Gas Chromatography

#Gas Chromatography Market Size

#Gas Chromatography Market Share

#Gas Chromatography Market Growth

#Gas Chromatography Market Trends

#Gas Chromatography Market Analysis

#Gas Chromatography Market Forecasts

#Luxury Leather Goods

#Luxury Leather Goods Market

#Luxury Leather Goods Market Size

#Luxury Leather Goods Market Share

#Luxury Leather Goods Market Growth

#Luxury Leather Goods Market Trends

#Luxury Leather Goods Market Analysis

#Luxury Leather Goods Market Forecasts

#Multiple Sclerosis Therapeutic

#Multiple Sclerosis Therapeutic Market

#Multiple Sclerosis Therapeutic Market Size

#Multiple Sclerosis Therapeutic Market Share

#Multiple Sclerosis Therapeutic Market Growth

#Multiple Sclerosis Therapeutic Market Trends

#Multiple Sclerosis Therapeutic Market Analysis

#Multiple Sclerosis Therapeutic Market Forecasts

#Transplant Diagnostics

#Transplant Diagnostics Market Size

#Transplant Diagnostics Market Share

#Transplant Diagnostics Market Growth

#Transplant Diagnostics Market Trends

#Transplant Diagnostics Market Analysis

#Transplant Diagnostics Market Forecasts

#Cellular IoT

#Cellular IoT Market

#Cellular IoT Market Size

#Cellular IoT Market Share

#Cellular IoT Market Growth

#Cellular IoT Market Trends

#Cellular IoT Market Analysis

#Cellular IoT Market Forecasts

#Ceramic Sanitary Ware Market

#Ceramic Sanitary Ware Market Size

#Ceramic Sanitary Ware Market Share

#Ceramic Sanitary Ware Market Growth

#Ceramic Sanitary Ware Market Trends

#Ceramic Sanitary Ware Market Analysis

#Ceramic Sanitary Ware Market Forecasts

#Dishwasher

#Dishwasher Market

#Dishwasher Market Size

#Dishwasher Market Share

#Dishwasher Market Growth

#Dishwasher Market Trends

#Dishwasher Market Analysis

#Dishwasher Market Forecasts

#Neem Extracts

#Neem Extracts Market

#Neem Extracts Market Size

#Neem Extracts Market Share

#Neem Extracts Market Growth

#Neem Extracts Market Trends

#Neem Extracts Market Analysis

#Neem Extracts Market Forecasts

#Structural Biology & Molecular Modeling Techniques

#Structural Biology & Molecular Modeling Techniques Market

#Structural Biology & Molecular Modeling Techniques Market Size

#Structural Biology & Molecular Modeling Techniques Market Share

#Structural Biology & Molecular Modeling Techniques Market Growth

#Structural Biology & Molecular Modeling Techniques Market Trends

#Structural Biology & Molecular Modeling Techniques Market Analysis

#Structural Biology & Molecular Modeling Techniques Market Forecasts

#Consumer IoT Market

#canned mushroom market

#Neuroendoscopy Devices Market

#Polycystic Ovarian Syndrome Treatment Market

#Thyroid Gland Disorder Treatment Market

#DNA Sequencing Market

#Dark Fiber Network Market

#Dark Fiber Network Market Share

#Dark Fiber Network Market Size

#Artificial Intelligence in Retail Market

#EV Charging Infrastructure Market

#India Online Grocery Market

#Pharmaceutical Manufacturing Market

#US Concierge Medicine Market

#US Revenue Cycle Management Market

#AI In Media & Entertainment Market

#Gluten-free Products Market

#Nutritional Supplements Market

#Point-of-Sale Software Market

#Sneakers Market

#U.S. Electric Vehicle Charging Infrastructure Market

#Wealth Management Software Market

#Golf Tourism

#Golf Tourism Market

#Golf Tourism Market Size

#Golf Tourism Market Share

#Golf Tourism Market Growth

#Golf Tourism Market Trends

#Golf Tourism Market Analysis

#Golf Tourism Market Forecasts

#Greeting Cards

#Greeting Cards Market

#Greeting Cards Market Size

#Greeting Cards Market Share

#Greeting Cards Market Growth

#Greeting Cards Market Trends

#Greeting Cards Market Analysis

#Greeting Cards Market Forecasts

#Hearing Aids Market Size

#Hearing Aids Market Share

#Hearing Aids Market Growth

#Hearing Aids Market Trends

#Hearing Aids Market Analysis

#Hearing Aids Market Forecasts

#Next Generation Sequencing

#Next Generation Sequencing Market Size

#Next Generation Sequencing Market Share

#Next Generation Sequencing Market Growth

#Next Generation Sequencing Market Trends

#Next Generation Sequencing Market Analysis

#Next Generation Sequencing Market Forecasts

#Skateboard Market

#Womens Health And Beauty Supplements Market

#Bioplastics Market Trends

#Bioplastics Market Analysis

#Bioplastics Market Forecasts

#Contract Cleaning Services

#Contract Cleaning Services Market

#Contract Cleaning Services Market Size

#Contract Cleaning Services Market Share

#Contract Cleaning Services Market Growth

#Contract Cleaning Services Market Trends

#Contract Cleaning Services Market Analysis

#Contract Cleaning Services Market Forecasts

#Hydrogen Energy Storage

#Hydrogen Energy Storage Market Growth

#Hydrogen Energy Storage Market Trends

#Hydrogen Energy Storage Market Analysis

#Hydrogen Energy Storage Market Forecasts

#IT Services Outsourcing Market

#Outdoor Furniture Market Size

#Outdoor Furniture Market Share

#Outdoor Furniture Market Growth

#Outdoor Furniture Market Trends

#Outdoor Furniture Market Analysis

#Outdoor Furniture Market Forecasts

#Stem Cells

#Stem Cells Market

#Stem Cells Market Size

#Stem Cells Market Share

#Stem Cells Market Growth

#Stem Cells Market Trends

#Stem Cells Market Analysis

#Stem Cells Market Forecasts

#Imaging Services Market

#Trade Credit Insurance

#Trade Credit Insurance Market

#Trade Credit Insurance Market Size

#Trade Credit Insurance Market Share

#Trade Credit Insurance Market Growth

#Trade Credit Insurance Market Trends

#Trade Credit Insurance Market Analysis

#Trade Credit Insurance Market Forecasts

#Weight Management Market

#Virtual Cards Market

#Sports Events Tickets Market

#Pet Grooming Services

#Pet Grooming Services Market

#Pet Grooming Services Market Size

#Pet Grooming Services Market Share

#Pet Grooming Services Market Growth

#Pet Grooming Services Market Trends

#Pet Grooming Services Market Analysis

#Pet Grooming Services Market Forecasts

#Cannabis Pharmaceuticals

#Cannabis Pharmaceuticals Market Size

#Cannabis Pharmaceuticals Market Share

#Cannabis Pharmaceuticals Market Growth

#Cannabis Pharmaceuticals Market Trends

#Cannabis Pharmaceuticals Market Analysis

#Cannabis Pharmaceuticals Market Forecasts

#US Laundry Facilities and Dry-Cleaning Services Market

#Shopping Centers

#Shopping Centers Market

#Shopping Centers Market Size

#Shopping Centers Market Share

#Shopping Centers Market Growth

#Shopping Centers Market Trends

#Shopping Centers Market Analysis

#Shopping Centers Market Forecasts

#Guitar Market

#Guitar Market Size

#Guitar Market Share

#Guitar Market Growth

#Guitar Market Trends

#Guitar Market Analysis

#Guitar Market Forecasts

#Dark Fiber Network

#Dark Fiber Network Market Growth

#Dark Fiber Network Market Trends

#Dark Fiber Network Market Analysis

#Dark Fiber Network Market Forecasts

#Metal Forging

#Metal Forging Market Size

#Metal Forging Market Share

#Metal Forging Market Growth

#Metal Forging Market Trends

#Metal Forging Market Analysis

#Metal Forging Market Forecasts

#India Coffee Retail Chains

#India Coffee Retail Chains Market

#India Coffee Retail Chains Market Size

#India Coffee Retail Chains Market Share

#India Coffee Retail Chains Market Growth

#India Coffee Retail Chains Market Trends

#India Coffee Retail Chains Market Analysis

#India Coffee Retail Chains Market Forecasts

#Power Tools Market Share

#Power Tools Market Growth

#Power Tools Market Trends

#Power Tools Market Analysis

#Power Tools Market Forecasts

#U.S. Transcription

#U.S. Transcription Market

#U.S. Transcription Market Size

#U.S. Transcription Market Share

#U.S. Transcription Market Growth

#U.S. Transcription Market Trends

#U.S. Transcription Market Analysis

#U.S. Transcription Market Forecasts

#Food Waste Management

#Food Waste Management Market Size

#Food Waste Management Market Share

#Food Waste Management Market Growth

#Food Waste Management Market Trends

#Food Waste Management Market Analysis

#Food Waste Management Market Forecasts

#Powder Coatings

#Powder Coatings Market Size

#Powder Coatings Market Share

#Powder Coatings Market Growth

#Powder Coatings Market Trends

#Powder Coatings Market Analysis

#Powder Coatings Market Forecasts

#Consumer IoT

#Consumer IoT Market Size

#Consumer IoT Market Share

#Consumer IoT Market Growth

#Consumer IoT Market Trends

#Consumer IoT Market Analysis

#Consumer IoT Market Forecasts

#Halal Food And Beverage Market

#Technical Textile

#Technical Textile Market

#Technical Textile Market Size

#Technical Textile Market Share

#Technical Textile Market Growth

#Technical Textile Market Trends

#Technical Textile Market Analysis

#Technical Textile Market Forecasts

#Australia And New Zealand Corporate Wellness

#Australia And New Zealand Corporate Wellness Market

#Australia And New Zealand Corporate Wellness Market Size

#Australia And New Zealand Corporate Wellness Market Share

#Australia And New Zealand Corporate Wellness Market Growth

#Australia And New Zealand Corporate Wellness Market Trends

#Australia And New Zealand Corporate Wellness Market Analysis

#Australia And New Zealand Corporate Wellness Market Forecasts

#Flavors And Fragrances Market

#Nuts Market

#Nuts Market Size

#Nuts Market Share

#Nuts Market Growth

#Nuts Market Trends

#Nuts Market Analysis

#Nuts Market Forecasts

#Structured Cabling

#Structured Cabling Market Size

#Structured Cabling Market Share

#Structured Cabling Market Growth

#Structured Cabling Market Trends

#Structured Cabling Market Analysis

#Structured Cabling Market Forecasts

#Artificial Intelligence In Retail

#Artificial Intelligence In Retail Market Size

#Artificial Intelligence In Retail Market Share

#Artificial Intelligence In Retail Market Growth

#Artificial Intelligence In Retail Market Trends

#Artificial Intelligence In Retail Market Analysis

#Artificial Intelligence In Retail Market Forecasts

#Elevators

#Elevators Market

#Elevators Market Size

#Elevators Market Share

#Elevators Market Growth

#Elevators Market Trends

#Elevators Market Analysis

#Elevators Market Forecasts

#Pharmaceutical CDMO

#Pharmaceutical CDMO Market

#Pharmaceutical CDMO Market Size

#Pharmaceutical CDMO Market Share

#Pharmaceutical CDMO Market Growth

#Pharmaceutical CDMO Market Trends

#Pharmaceutical CDMO Market Analysis

#Pharmaceutical CDMO Market Forecasts

#Data Monetization

#Data Monetization Market

#Data Monetization Market Size

#Data Monetization Market Share

#Data Monetization Market Growth

#Data Monetization Market Trends

#Data Monetization Market Analysis

#Data Monetization Market Forecasts

#Hunting Equipment & Accessories

#Hunting Equipment & Accessories Market

#Hunting Equipment & Accessories Market Size

#Hunting Equipment & Accessories Market Share

#Hunting Equipment & Accessories Market Growth

#Hunting Equipment & Accessories Market Trends

#Hunting Equipment & Accessories Market Analysis

#Hunting Equipment & Accessories Market Forecasts

#Salmon Fish Market

#Salmon Fish Market Size

#Salmon Fish Market Share

#Salmon Fish Market Growth

#Salmon Fish Market Trends

#Salmon Fish Market Analysis

#Salmon Fish Market Forecasts

#Aquafeed

#Aquafeed Market

#Aquafeed Market Size

#Aquafeed Market Share

#Aquafeed Market Growth

#Aquafeed Market Trends

#Aquafeed Market Analysis

#Aquafeed Market Forecasts

#Corrugated Board

#Corrugated Board Market

#Corrugated Board Market Size

#Corrugated Board Market Share

#Corrugated Board Market Trends

#Corrugated Board Market Analysis

#Corrugated Board Market Forecasts

#Intelligent Traffic Management System

#Intelligent Traffic Management System Market

#Intelligent Traffic Management System Market Size

#Intelligent Traffic Management System Market Share

#Intelligent Traffic Management System Market Growth

#Intelligent Traffic Management System Market Trends

#Intelligent Traffic Management System Market Analysis

#Intelligent Traffic Management System Market Forecasts

#Nanomaterials

#Nanomaterials Market

#Nanomaterials Market Size

#Nanomaterials Market Share

#Nanomaterials Market Growth

#Nanomaterials Market Trends

#Nanomaterials Market Analysis

#Nanomaterials Market Forecasts

#Practice Management System

#Practice Management System Market

#Practice Management System Market Size

#Practice Management System Market Share

#Practice Management System Market Growth

#Practice Management System Market Trends

#Practice Management System Market Analysis

#Practice Management System Market Forecasts

#Data Analytics Market

#Data Analytics Market Size

#Data Analytics Market Share

#Data Analytics Market Growth

#Data Analytics Market Trends

#Data Analytics Market Analysis

#Data Analytics Market Forecasts

#Industrial Air Filtration

#Industrial Air Filtration Market Size

#Industrial Air Filtration Market Share

#Industrial Air Filtration Market Growth

#Industrial Air Filtration Market Trends

#Industrial Air Filtration Market Analysis

#Industrial Air Filtration Market Forecasts

#Off-road Motorcycles

#Off-road Motorcycles Market

#Off-road Motorcycles Market Size

#Off-road Motorcycles Market Share

#Off-road Motorcycles Market Growth

#Off-road Motorcycles Market Trends

#Off-road Motorcycles Market Analysis

#Off-road Motorcycles Market Forecasts

#Shea Butter

#Shea Butter Market

#Shea Butter Market Size

#Shea Butter Market Share

#Shea Butter Market Growth

#Shea Butter Market Trends

#Shea Butter Market Analysis

#Shea Butter Market Forecasts

#Aluminum Die Casting Market Growth

#Aluminum Die Casting Market Trends

#Aluminum Die Casting Market Analysis

#Aluminum Die Casting Market Forecasts

#DNA Sequencing

#DNA Sequencing Market Size

#DNA Sequencing Market Share

#DNA Sequencing Market Growth

#DNA Sequencing Market Trends

#DNA Sequencing Market Analysis

#DNA Sequencing Market Forecasts

#Heat Treating

#Heat Treating Market

#Heat Treating Market Size

#Heat Treating Market Share

#Heat Treating Market Growth

#Heat Treating Market Trends

#Heat Treating Market Analysis

#Heat Treating Market Forecasts

#Metalworking Fluids

#Metalworking Fluids Market Analysis

#Metalworking Fluids Market Forecasts

#Softgel Capsules Market Size

#Softgel Capsules Market Share

#Softgel Capsules Market Growth

#Softgel Capsules Market Trends

#Softgel Capsules Market Analysis

#Softgel Capsules Market Forecasts

#Alternative Accommodation

#Alternative Accommodation Market

#Alternative Accommodation Market Size

#Alternative Accommodation Market Share

#Alternative Accommodation Market Growth

#Alternative Accommodation Market Trends

#Alternative Accommodation Market Analysis

#Alternative Accommodation Market Forecasts

#Custom Printing Market

#Custom Printing Market Size

#Custom Printing Market Share

#Custom Printing Market Growth

#Custom Printing Market Trends

#Custom Printing Market Analysis

#Custom Printing Market Forecasts

#Field Programmable Gate Array (FPGA)

#FPGA Market

#Field Programmable Gate Array (FPGA) Market Size

#Field Programmable Gate Array (FPGA) Market Share

#FPGA Market Growth

#Field Programmable Gate Array (FPGA) Market Trends

#Field Programmable Gate Array (FPGA) Market Analysis

#FPGA Market Forecasts

#Long Steel Products

#Long Steel Products Market Size

#Long Steel Products Market Share

#Long Steel Products Market Trends

#Long Steel Products Market Analysis

#Recycling Equipment

#Recycling Equipment Market

#Recycling Equipment Market Size

#Recycling Equipment Market Share

#Recycling Equipment Market Growth

#Recycling Equipment Market Trends

#Recycling Equipment Market Analysis

#Recycling Equipment Market Forecasts

#5G Radio Access Network

#5G Radio Access Network Market

#5G Radio Access Network Market Size

#5G Radio Access Network Market Share

#5G Radio Access Network Market Growth

#5G Radio Access Network Market Trends

#5G Radio Access Network Market Analysis

#5G Radio Access Network Market Forecasts

#Cochlear Implant

#Cochlear Implant Market

#Cochlear Implant Market Size

#Cochlear Implant Market Share

#Cochlear Implant Market Growth

#Cochlear Implant Market Trends

#Cochlear Implant Market Analysis

#Cochlear Implant Market Forecasts

#Hair Color Market

#Hair Color Market Size

#Hair Color Market Share

#Hair Color Market Growth

#Hair Color Market Trends

#Hair Color Market Analysis

#Hair Color Market Forecasts

#Personal Mobility Devices

#Personal Mobility Devices Market Share

#Personal Mobility Devices Market Growth

#Personal Mobility Devices Market Trends

#Personal Mobility Devices Market Analysis

#Personal Mobility Devices Market Forecasts

#Surgical Sutures

#Surgical Sutures Market Share

#Surgical Sutures Market Growth

#Surgical Sutures Market Trends

#Surgical Sutures Market Analysis

#Surgical Sutures Market Forecasts

#Waterproofing Membranes Market

#Waterproofing Membranes Market Size

#Waterproofing Membranes Market Share

#Waterproofing Membranes Market Growth

#Waterproofing Membranes Market Trends

#Waterproofing Membranes Market Analysis

#Waterproofing Membranes Market Forecasts

#Bakery Products

#Bakery Products Market

#Bakery Products Market Size

#Bakery Products Market Share

#Bakery Products Market Growth

#Bakery Products Market Trends

#Bakery Products Market Analysis

#Bakery Products Market Forecasts

#Data Lake Market Trends

#Data Lake Market Analysis

#Data Lake Market Forecasts

#Heat-Not-Burn

#Heat-Not-Burn Market

#Heat-Not-Burn Market Size

#Heat-Not-Burn Market Share

#Heat-Not-Burn Market Growth

#Heat-Not-Burn Market Trends

#Heat-Not-Burn Market Analysis

#Heat-Not-Burn Market Forecasts

#Mushroom Coffee

#Mushroom Coffee Market

#Mushroom Coffee Market Size

#Mushroom Coffee Market Share

#Mushroom Coffee Market Growth

#Mushroom Coffee Market Trends

#Mushroom Coffee Market Analysis

#Mushroom Coffee Market Forecasts

#Packaged Salad

#Packaged Salad Market Size

#Packaged Salad Market Share

#Packaged Salad Market Growth

#Packaged Salad Market Trends

#Packaged Salad Market Analysis

#Packaged Salad Market Forecasts

#Security Printing

#Security Printing Market

#Security Printing Market Size

#Security Printing Market Share

#Security Printing Market Growth

#Security Printing Market Trends

#Security Printing Market Analysis

#Security Printing Market Forecasts

#Vegan Cosmetics Market Size

#Vegan Cosmetics Market Share

#Vegan Cosmetics Market Growth

#Vegan Cosmetics Market Trends

#Vegan Cosmetics Market Analysis

#Vegan Cosmetics Market Forecasts

#Automotive Data Management Market

#China Business Process Outsourcing

#China Business Process Outsourcing Market

#China Business Process Outsourcing Market Size

#China Business Process Outsourcing Market Share

#China Business Process Outsourcing Market Growth

#China Business Process Outsourcing Market Trends

#China Business Process Outsourcing Market Analysis

#China Business Process Outsourcing Market Forecasts

#Energy Storage As A Service

#Energy Storage As A Service Market

#Energy Storage As A Service Market Size

#Energy Storage As A Service Market Share

#Energy Storage As A Service Market Growth

#Energy Storage As A Service Market Trends

#Energy Storage As A Service Market Analysis

#Energy Storage As A Service Market Forecasts

#Induced Pluripotent Stem Cells Production

#Induced Pluripotent Stem Cells Production Market

#Induced Pluripotent Stem Cells Production Market Size

#Induced Pluripotent Stem Cells Production Market Share

#Induced Pluripotent Stem Cells Production Market Growth

#Induced Pluripotent Stem Cells Production Market Trends

#Induced Pluripotent Stem Cells Production Market Analysis

#Induced Pluripotent Stem Cells Production Market Forecasts

#Microneedling Market

#Microneedling Market Size

#Microneedling Market Share

#Microneedling Market Growth

#Microneedling Market Trends

#Microneedling Market Analysis

#Microneedling Market Forecasts

#PET Scanners

#PET Scanners Market

#PET Scanners Market Size

#PET Scanners Market Share

#PET Scanners Market Growth

#PET Scanners Market Trends

#PET Scanners Market Analysis

#PET Scanners Market Forecasts

#Self-service Kiosk

#Self-service Kiosk Market

#Self-service Kiosk Market Size

#Self-service Kiosk Market Share

#Self-service Kiosk Market Growth

#Self-service Kiosk Market Trends

#Self-service Kiosk Market Analysis

#Self-service Kiosk Market Forecasts

#U.S. Independent Diagnostic Testing Facility

#U.S. Independent Diagnostic Testing Facility Market

#U.S. Independent Diagnostic Testing Facility Market Size

#U.S. Independent Diagnostic Testing Facility Market Share

#U.S. Independent Diagnostic Testing Facility Market Growth

#U.S. Independent Diagnostic Testing Facility Market Trends

#U.S. Independent Diagnostic Testing Facility Market Analysis

#U.S. Independent Diagnostic Testing Facility Market Forecasts

#3D Printing Filament

#3D Printing Filament Market Size

#3D Printing Filament Market Share

#3D Printing Filament Market Growth

#3D Printing Filament Market Trends

#3D Printing Filament Market Analysis

#3D Printing Filament Market Forecasts

#Container Glass

#Container Glass Market

#Container Glass Market Size

#Container Glass Market Share

#Container Glass Market Growth

#Container Glass Market Trends

#Container Glass Market Analysis

#Container Glass Market Forecasts

#Everything As A Service Market Size

#Everything As A Service Market Share

#Everything As A Service Market Growth

#Everything As A Service Market Trends

#Everything As A Service Market Analysis

#Everything As A Service Market Forecasts

#Heavy-duty Automotive Aftermarket

#Heavy-duty Automotive Aftermarket Size

#Heavy-duty Automotive Aftermarket Share

#Heavy-duty Automotive Aftermarket Growth

#Heavy-duty Automotive Aftermarket Trends

#Heavy-duty Automotive Aftermarket Analysis

#Heavy-duty Automotive Aftermarket Forecasts

#Membrane Bioreactor Market Size

#Membrane Bioreactor Market Share

#Membrane Bioreactor Market Growth

#Membrane Bioreactor Market Trends

#Membrane Bioreactor Market Analysis

#Membrane Bioreactor Market Forecasts

#Opioid

#Opioid Market

#Opioid Market Size

#Opioid Market Share

#Opioid Market Growth

#Opioid Market Trends

#Opioid Market Analysis

#Opioid Market Forecasts

#Reclaimed Lumber Market Size

#Reclaimed Lumber Market Share

#Reclaimed Lumber Market Growth

#Reclaimed Lumber Market Trends

#Reclaimed Lumber Market Analysis

#Reclaimed Lumber Market Forecasts

#Super-resolution Microscopes

#Super-resolution Microscopes Market

#Super-resolution Microscopes Market Size

#Super-resolution Microscopes Market Share

#Super-resolution Microscopes Market Growth

#Super-resolution Microscopes Market Trends

#Super-resolution Microscopes Market Analysis

#Super-resolution Microscopes Market Forecasts

#Waterless Cosmetics

#Waterless Cosmetics Market

#Waterless Cosmetics Market Size

#Waterless Cosmetics Market Share

#Waterless Cosmetics Market Growth

#Waterless Cosmetics Market Trends

#Waterless Cosmetics Market Analysis

#Waterless Cosmetics Market Forecasts

#Biosimilars

#Biosimilars Market Size

#Biosimilars Market Share

#Biosimilars Market Growth

#Biosimilars Market Trends

#Biosimilars Market Forecasts

#Data Fabric

#Data Fabric Market Share

#Data Fabric Market Growth

#Data Fabric Market Trends

#Data Fabric Market Analysis

#Data Fabric Market Forecasts

#Hard Kombucha

#Hard Kombucha Market

#Hard Kombucha Market Size

#Hard Kombucha Market Share

#Hard Kombucha Market Growth

#Hard Kombucha Market Trends

#Hard Kombucha Market Analysis

#Hard Kombucha Market Forecasts

#Infection Control

#Infection Control Market Share

#Infection Control Market Growth

#Infection Control Market Trends

#Infection Control Market Analysis

#Infection Control Market Forecasts

#Medical Supply Delivery Service

#Medical Supply Delivery Service Market

#Medical Supply Delivery Service Market Size

#Medical Supply Delivery Service Market Share

#Medical Supply Delivery Service Market Growth

#Medical Supply Delivery Service Market Trends

#Medical Supply Delivery Service Market Analysis

#Medical Supply Delivery Service Market Forecasts

#Personal Care Shower And Bath

#Personal Care Shower And Bath Market

#Personal Care Shower And Bath Market Size

#Personal Care Shower And Bath Market Share

#Personal Care Shower And Bath Market Growth

#Personal Care Shower And Bath Market Trends

#Personal Care Shower And Bath Market Analysis

#Personal Care Shower And Bath Market Forecasts

#Roofing Materials Market Size

#Roofing Materials Market Share

#Roofing Materials Market Growth

#Roofing Materials Market Trends

#Roofing Materials Market Forecasts

#Structural Insulated Panels

#Structural Insulated Panels Market

#Structural Insulated Panels Market Size

#Structural Insulated Panels Market Share

#Structural Insulated Panels Market Growth

#Structural Insulated Panels Market Trends

#Structural Insulated Panels Market Analysis

#Structural Insulated Panels Market Forecasts

#Vendor Risk Management

#Vendor Risk Management Market

#Vendor Risk Management Market Size

#Vendor Risk Management Market Share

#Vendor Risk Management Market Growth

#Vendor Risk Management Market Trends

#Vendor Risk Management Market Analysis

#Vendor Risk Management Market Forecasts

#Automotive Transmission

#Automotive Transmission Market Size

#Automotive Transmission Market Share

#Automotive Transmission Market Growth

#Automotive Transmission Market Trends

#Automotive Transmission Market Analysis

#Automotive Transmission Market Forecasts

#Coronary Artery Bypass Graft

#Coronary Artery Bypass Graft Market

#Coronary Artery Bypass Graft Market Size

#Coronary Artery Bypass Graft Market Share

#Coronary Artery Bypass Graft Market Growth

#Coronary Artery Bypass Graft Market Trends

#Coronary Artery Bypass Graft Market Analysis

#Coronary Artery Bypass Graft Market Forecasts

#Electric Vehicle Battery Recycling

#Electric Vehicle Battery Recycling Market

#Electric Vehicle (EV) Battery Recycling Market Size

#EV Battery Recycling Market Share

#Electric Vehicle Battery Recycling Market Growth

#EV Battery Recycling Market Trends

#Electric Vehicle (EV) Battery Recycling Market Analysis

#EV Market Forecasts

#Fresh Fish

#Fresh Fish Market

#Fresh Fish Market Size

#Fresh Fish Market Share

#Fresh Fish Market Growth

#Fresh Fish Market Trends

#Fresh Fish Market Analysis

#Fresh Fish Market Forecasts

#Intracranial Pressure Monitoring Devices

#Intracranial Pressure Monitoring Devices Market

#Intracranial Pressure Monitoring Devices Market Size

#Intracranial Pressure Monitoring Devices Market Share

#Intracranial Pressure Monitoring Devices Market Growth

#Intracranial Pressure Monitoring Devices Market Trends

#Intracranial Pressure Monitoring Devices Market Analysis

#Intracranial Pressure Monitoring Devices Market Forecasts

#Medical Textiles

#Medical Textiles Market

#Medical Textiles Market Size

#Medical Textiles Market Share

#Medical Textiles Market Growth

#Medical Textiles Market Trends

#Medical Textiles Market Analysis

#Medical Textiles Market Forecasts

#Nitric Acid Market Size

#Nitric Acid Market Share

#Nitric Acid Market Growth

#Nitric Acid Market Trends

#Nitric Acid Market Analysis

#Nitric Acid Market Forecasts

#Postpartum Products

#Postpartum Products Market

#Postpartum Products Market Size

#Postpartum Products Market Share

#Postpartum Products Market Growth

#Postpartum Products Market Trends

#Postpartum Products Market Analysis

#Postpartum Products Market Forecasts

#Smart Contracts Market

#Smart Contracts Market Size

#Smart Contracts Market Share

#Smart Contracts Market Growth

#Smart Contracts Market Trends

#Smart Contracts Market Analysis

#Smart Contracts Market Forecasts

#U.S. Behavioral Health Care Software And Services

#U.S. Behavioral Health Care Software And Services Market

#U.S. Behavioral Health Care Software And Services Market Size

#U.S. Behavioral Health Care Software And Services Market Share

#U.S. Behavioral Health Care Software And Services Market Growth

#U.S. Behavioral Health Care Software And Services Market Trends

#U.S. Behavioral Health Care Software And Services Market Analysis

#U.S. Behavioral Health Care Software And Services Market Forecasts

#U.S. Semi-Trailer Dealership

#U.S. Semi-Trailer Dealership Market

#U.S. Semi-Trailer Dealership Market Size

#U.S. Semi-Trailer Dealership Market Share

#U.S. Semi-Trailer Dealership Market Growth

#U.S. Semi-Trailer Dealership Market Trends

#U.S. Semi-Trailer Dealership Market Analysis

#U.S. Semi-Trailer Dealership Market Forecasts

#Advanced Ceramics Market Share

#Advanced Ceramics Market Trends

#Advanced Ceramics Market Analysis

#Advanced Ceramics Market Forecasts

#Automotive Adhesive Tapes

#Automotive Adhesive Tapes Market

#Automotive Adhesive Tapes Market Size

#Automotive Adhesive Tapes Market Share

#Automotive Adhesive Tapes Market Growth

#Automotive Adhesive Tapes Market Trends

#Automotive Adhesive Tapes Market Analysis

#Automotive Adhesive Tapes Market Forecasts

#Car Phone Holder

#Car Phone Holder Market

#Car Phone Holder Market Size

#Car Phone Holder Market Share

#Car Phone Holder Market Growth

#Car Phone Holder Market Trends

#Car Phone Holder Market Analysis

#Car Phone Holder Market Forecasts

#Decarbonization

#Decarbonization Market

#Decarbonization Market Size

#Decarbonization Market Share

#Decarbonization Market Growth

#Decarbonization Market Trends

#Decarbonization Market Analysis

#Decarbonization Market Forecasts

#Europe Mobility Aids

#Europe Mobility Aids Market

#Europe Mobility Aids Market Size

#Europe Mobility Aids Market Share

#Europe Mobility Aids Market Growth

#Europe Mobility Aids Market Trends

#Europe Mobility Aids Market Analysis

#Europe Mobility Aids Market Forecasts

#HR Software Market

#HR Software Market Size

#HR Software Market Share

#HR Software Market Growth

#HR Software Market Trends

#HR Software Market Analysis

#HR Software Market Forecasts

#LED Modular Display

#LED Modular Display Market

#LED Modular Display Market Size

#LED Modular Display Market Share

#LED Modular Display Market Growth

#LED Modular Display Market Trends

#LED Modular Display Market Analysis

#LED Modular Display Market Forecasts

#North America Food Packaging

#North America Food Packaging Market

#North America Food Packaging Market Size

#North America Food Packaging Market Share

#North America Food Packaging Market Growth

#North America Food Packaging Market Trends

#North America Food Packaging Market Analysis

#North America Food Packaging Market Forecasts

#Pet Shampoo

#Pet Shampoo Market

#Pet Shampoo Market Size

#Pet Shampoo Market Share

#Pet Shampoo Market Growth

#Pet Shampoo Market Trends

#Pet Shampoo Market Analysis

#Pet Shampoo Market Forecasts

#RNA Targeting Small Molecule Drug Discovery Market

#3D Printing Market Size

#3D Printing Market Share

#3D Printing Market Growth

#3D Printing Market Trends

#3D Printing Market Analysis

#3D Printing Market Forecasts

#U.S. Railing

#U.S. Railing Market

#U.S. Railing Market Size

#U.S. Railing Market Share

#U.S. Railing Market Growth

#U.S. Railing Market Trends

#U.S. Railing Market Analysis

#U.S. Railing Market Forecasts

#X-ray Security Screening

#X-ray Security Screening Market

#X-ray Security Screening Market Size

#X-ray Security Screening Market Share

#X-ray Security Screening Market Growth

#X-ray Security Screening Market Trends

#X-ray Security Screening Market Analysis

#X-ray Security Screening Market Forecasts

#Asia Pacific Group Health Insurance

#Asia Pacific Group Health Insurance Market

#Asia Pacific Group Health Insurance Market Size

#Asia Pacific Group Health Insurance Market Share

#Asia Pacific Group Health Insurance Market Growth

#Asia Pacific Group Health Insurance Market Trends

#Asia Pacific Group Health Insurance Market Analysis

#Asia Pacific Group Health Insurance Market Forecasts

#Blockchain Messaging Apps

#Blockchain Messaging Apps Market

#Blockchain Messaging Apps Market Size

#Blockchain Messaging Apps Market Share

#Blockchain Messaging Apps Market Growth

#Blockchain Messaging Apps Market Trends

#Blockchain Messaging Apps Market Analysis

#Blockchain Messaging Apps Market Forecasts

#Compact Electric Construction Equipment

#Compact Electric Construction Equipment Market

#Compact Electric Construction Equipment Market Size

#Compact Electric Construction Equipment Market Share

#Compact Electric Construction Equipment Market Growth

#Compact Electric Construction Equipment Market Trends

#Compact Electric Construction Equipment Market Analysis

#Compact Electric Construction Equipment Market Forecasts

#Decorated Apparel

#Decorated Apparel Market

#Decorated Apparel Market Size

#Decorated Apparel Market Share

#Decorated Apparel Market Growth

#Decorated Apparel Market Trends

#Decorated Apparel Market Analysis

#Decorated Apparel Market Forecasts

#Egypt Book Services

#Egypt Book Services Market

#Egypt Book Services Market Size

#Egypt Book Services Market Share

#Egypt Book Services Market Growth

#Egypt Book Services Market Trends

#Egypt Book Services Market Analysis

#Egypt Book Services Market Forecasts

#Swine Vaccines

#Swine Vaccines Market

#Swine Vaccines Market Size

#Swine Vaccines Market Share

#Swine Vaccines Market Growth

#Swine Vaccines Market Trends

#Swine Vaccines Market Analysis

#Swine Vaccines Market Forecasts

#Fixed Voice

#Fixed Voice Market

#Fixed Voice Market Size

#Fixed Voice Market Share

#Fixed Voice Market Growth

#Fixed Voice Market Trends

#Fixed Voice Market Analysis

#Fixed Voice Market Forecasts

#Healthcare Data Collection And Labeling

#Healthcare Data Collection And Labeling Market

#Healthcare Data Collection And Labeling Market Size

#Healthcare Data Collection And Labeling Market Share

#Healthcare Data Collection And Labeling Market Growth

#Healthcare Data Collection And Labeling Market Trends

#Healthcare Data Collection And Labeling Market Analysis

#Healthcare Data Collection And Labeling Market Forecasts

#Hosiery Market

#Hosiery Market Size

#Hosiery Market Share

#Hosiery Market Growth

#Hosiery Market Trends

#Hosiery Market Analysis

#Hosiery Market Forecasts

#K-Beauty Products

#K-Beauty Products Market

#K-Beauty Products Market Size

#K-Beauty Products Market Share

#K-Beauty Products Market Growth

#K-Beauty Products Market Trends

#K-Beauty Products Market Analysis

#K-Beauty Products Market Forecasts

#Microwave Ablation

#Microwave Ablation Market

#Microwave Ablation Market Size

#Microwave Ablation Market Share

#Microwave Ablation Market Growth

#Microwave Ablation Market Trends

#Microwave Ablation Market Analysis

#Microwave Ablation Market Forecasts

#Oral Clinical Nutrition

#Oral Clinical Nutrition Market

#Oral Clinical Nutrition Market Size

#Oral Clinical Nutrition Market Share

#Oral Clinical Nutrition Market Growth

#Oral Clinical Nutrition Market Trends

#Oral Clinical Nutrition Market Analysis

#Oral Clinical Nutrition Market Forecasts

#Point Of Entry Water Treatment Systems

#Point Of Entry Water Treatment Systems Market

#Point Of Entry Water Treatment Systems Market Size

#Point Of Entry Water Treatment Systems Market Share

#Point Of Entry Water Treatment Systems Market Growth

#Point Of Entry Water Treatment Systems Market Trends

#Point Of Entry Water Treatment Systems Market Analysis

#Point Of Entry Water Treatment Systems Market Forecasts

#Semi-trailer Market

#Semi-trailer Market Size

#Semi-trailer Market Share

#Semi-trailer Market Growth

#Semi-trailer Market Trends

#Semi-trailer Market Analysis

#Semi-trailer Market Forecasts

#Southeast Asia Pipes

#Southeast Asia Pipes Market

#Southeast Asia Pipes Market Size

#Southeast Asia Pipes Market Share

#Southeast Asia Pipes Market Growth

#Southeast Asia Pipes Market Trends

#Southeast Asia Pipes Market Analysis

#Southeast Asia Pipes Market Forecasts

#Textile Flame Retardants

#Textile Flame Retardants Market

#Textile Flame Retardants Market Size

#Textile Flame Retardants Market Share

#Textile Flame Retardants Market Growth

#Textile Flame Retardants Market Trends

#Textile Flame Retardants Market Analysis

#Textile Flame Retardants Market Forecasts

#U.S. Medicare Supplement Health Insurance

#U.S. Medicare Supplement Health Insurance Market

#U.S. Medicare Supplement Health Insurance Market Size

#U.S. Medicare Supplement Health Insurance Market Share

#U.S. Medicare Supplement Health Insurance Market Growth

#U.S. Medicare Supplement Health Insurance Market Trends

#U.S. Medicare Supplement Health Insurance Market Analysis

#U.S. Medicare Supplement Health Insurance Market Forecasts

#Anti-vascular Endothelial Growth Factor Therapeutics Market

#Bean Bag Chairs

#Bean Bag Chairs Market

#Bean Bag Chairs Market Size

#Bean Bag Chairs Market Share

#Bean Bag Chairs Market Growth

#Bean Bag Chairs Market Trends

#Bean Bag Chairs Market Analysis

#Bean Bag Chairs Market Forecasts

#Bulk Food Ingredients

#Bulk Food Ingredients Market

#Bulk Food Ingredients Market Size

#Bulk Food Ingredients Market Share

#Bulk Food Ingredients Market Growth

#Bulk Food Ingredients Market Trends

#Bulk Food Ingredients Market Analysis

#Bulk Food Ingredients Market Forecasts

#Consumer Electronics

#Consumer Electronics Market

#Consumer Electronics Market Size

#Consumer Electronics Market Share

#Consumer Electronics Market Growth

#Consumer Electronics Market Trends

#Consumer Electronics Market Analysis

#Consumer Electronics Market Forecasts

#Fragrance Market

#Fragrance Market Size

#Fragrance Market Share

#Fragrance Market Growth

#Fragrance Market Trends

#Fragrance Market Analysis

#Fragrance Market Forecasts

#U.S. Physician Groups

#U.S. Physician Groups Market

#U.S. Physician Groups Market Size

#U.S. Physician Groups Market Share

#U.S. Physician Groups Market Growth

#U.S. Physician Groups Market Trends

#U.S. Physician Groups Market Analysis

#U.S. Physician Groups Market Forecasts

#UK Lifestyle Sneakers

#UK Lifestyle Sneakers Market

#UK Lifestyle Sneakers Market Size

#UK Lifestyle Sneakers Market Share

#UK Lifestyle Sneakers Market Growth

#UK Lifestyle Sneakers Market Trends

#UK Lifestyle Sneakers Market Analysis

#UK Lifestyle Sneakers Market Forecasts

#Spa Services Market

#Spa Services Market Size

#Spa Services Market Share

#Spa Services Market Growth

#Spa Services Market Trends

#Spa Services Market Analysis

#Spa Services Market Forecasts

#North America Acute Care Telemedicine

#North America Acute Care Telemedicine Market

#North America Acute Care Telemedicine Market Size

#North America Acute Care Telemedicine Market Share

#North America Acute Care Telemedicine Market Growth

#North America Acute Care Telemedicine Market Trends

#North America Acute Care Telemedicine Market Analysis

#North America Acute Care Telemedicine Market Forecasts

#Cleaning And Hygiene Products

#Cleaning And Hygiene Products Market

#Cleaning And Hygiene Products Market Size

#Cleaning And Hygiene Products Market Share

#Cleaning And Hygiene Products Market Growth

#Cleaning And Hygiene Products Market Trends

#Cleaning And Hygiene Products Market Analysis

#Cleaning And Hygiene Products Market Forecasts

#Deepfake AI

#Deepfake AI Market

#Deepfake AI Market Size

#Deepfake AI Market Share

#Deepfake AI Market Growth

#Deepfake AI Market Trends

#Deepfake AI Market Analysis

#Deepfake AI Market Forecasts

#4 Butanediol

#4 Butanediol Market

#4 Butanediol Market Size

#4 Butanediol Market Share

#4 Butanediol Market Growth

#4 Butanediol Market Trends

#4 Butanediol Market Analysis

#4 Butanediol Market Forecasts

#Generative AI in Music

#Generative AI in Music Market Growth

#Generative AI in Music Market Trends

#Generative AI in Music Market Analysis

#Generative AI in Music Market Forecasts

#THC Seltzers

#THC Seltzers Market

#THC Seltzers Market Size

#THC Seltzers Market Share

#THC Seltzers Market Growth

#THC Seltzers Market Trends

#THC Seltzers Market Analysis

#THC Seltzers Market Forecasts

#U.S. Telecom Services

#U.S. Telecom Services Market

#U.S. Telecom Services Market Size

#U.S. Telecom Services Market Share

#U.S. Telecom Services Market Growth

#U.S. Telecom Services Market Trends

#U.S. Telecom Services Market Analysis

#U.S. Telecom Services Market Forecasts

#Internet of Things Market Forecasts

#Yacht Market Growth

#Yacht Market Trends

#Yacht Market Analysis

#Yacht Market Forecasts

#Electric Ship Market Analysis

#Electric Ship Market Forecasts

#Fire Department Software

#Fire Department Software Market

#Fire Department Software Market Size

#Fire Department Software Market Share

#Fire Department Software Market Growth

#Fire Department Software Market Trends

#Fire Department Software Market Analysis

#Fire Department Software Market Forecasts

#Germany Automotive Aftermarket

#Germany Automotive Aftermarket Size

#Germany Automotive Aftermarket Share

#Germany Automotive Aftermarket Growth

#Germany Automotive Aftermarket Trends

#Germany Automotive Aftermarket Analysis

#Germany Automotive Aftermarket Forecasts

#Hospital Consumables

#Hospital Consumables Market

#Hospital Consumables Market Size

#Hospital Consumables Market Share

#Hospital Consumables Market Growth

#Hospital Consumables Market Trends

#Hospital Consumables Market Analysis

#Hospital Consumables Market Forecasts

#Kids Scooter Market

#Kids Scooter Market Size

#Kids Scooter Market Share

#Kids Scooter Market Growth

#Kids Scooter Market Trends

#Kids Scooter Market Analysis

#Kids Scooter Market Forecasts

#Medical Automation

#Medical Automation Market

#Medical Automation Market Size

#Medical Automation Market Share

#Medical Automation Market Growth

#Medical Automation Market Trends

#Medical Automation Market Analysis

#Medical Automation Market Forecasts

#Minimally Invasive Surgical Instruments

#Minimally Invasive Surgical Instruments Market Trends

#Minimally Invasive Surgical Instruments Market Analysis

#Minimally Invasive Surgical Instruments Market Forecasts

#North America Steel Rebar

#North America Steel Rebar Market

#North America Steel Rebar Market Size

#North America Steel Rebar Market Share

#North America Steel Rebar Market Growth

#North America Steel Rebar Market Trends

#North America Steel Rebar Market Analysis

#North America Steel Rebar Market Forecasts

#Pipette Tips Market

#Pipette Tips Market Size

#Pipette Tips Market Share

#Pipette Tips Market Growth

#Pipette Tips Market Trends

#Pipette Tips Market Analysis

#Pipette Tips Market Forecasts

#Private Cloud Server

#Private Cloud Server Market

#Private Cloud Server Market Size

#Private Cloud Server Market Share

#Private Cloud Server Market Growth

#Private Cloud Server Market Trends

#Private Cloud Server Market Analysis

#Private Cloud Server Market Forecasts

#Self-healing Concrete

#Self-healing Concrete Market Share

#Self-healing Concrete Market Growth

#Self-healing Concrete Market Trends

#Self-healing Concrete Market Analysis

#Self-healing Concrete Market Forecasts

#Streaming Analytics

#Streaming Analytics Market Size

#Streaming Analytics Market Share

#Streaming Analytics Market Growth

#Streaming Analytics Market Trends

#Streaming Analytics Market Analysis

#Streaming Analytics Market Forecasts

#Queue Management System

#Queue Management System Market

#Queue Management System Market Size

#Queue Management System Market Share

#Queue Management System Market Analysis

#Queue Management System Market Forecasts

#UK Kids Furniture Market

#Healthcare Asset Management Market

#Indoor Distributed Antenna Systems Market

#North America Urinary Tract Infection Testing Market

#Collectibles Market

#Collectibles Market Size

#Collectibles Market Share

#Collectibles Market Growth

#Collectibles Market Trends

#Collectibles Market Analysis

#Collectibles Market Forecasts

#Color Cosmetics

#Color Cosmetics Market Share

#Color Cosmetics Market Growth

#Color Cosmetics Market Trends

#Color Cosmetics Market Analysis

#Color Cosmetics Market Forecasts

#Companion Diagnostics

#Companion Diagnostics Market Size

#Companion Diagnostics Market Share

#Companion Diagnostics Market Growth

#Companion Diagnostics Market Trends

#Companion Diagnostics Market Analysis

#Companion Diagnostics Market Forecasts

#Cookies

#Cookies Market

#Cookies Market Size

#Cookies Market Share

#Cookies Market Growth

#Cookies Market Trends

#Cookies Market Analysis

#Cookies Market Forecasts

#Cosmetics Market

#Cosmetics Market Size

#Cosmetics Market Share

#Cosmetics Market Growth

#Cosmetics Market Trends

#Cosmetics Market Analysis

#Cosmetics Market Forecasts

#Europe Kombucha

#Europe Kombucha Market

#Europe Kombucha Market Size

#Europe Kombucha Market Share

#Europe Kombucha Market Growth

#Europe Kombucha Market Trends

#Europe Kombucha Market Analysis

#Europe Kombucha Market Forecasts

Archives

Pharmaceutical CDMO Market 2030: Enhancing Drug Delivery System

-

Posted by Henry Paul Filed in Health #Pharmaceutical CDMO #Pharmaceutical CDMO Market #Pharmaceutical CDMO Market Size #Pharmaceutical CDMO Market Share #Pharmaceutical CDMO Market Growth #Pharmaceutical CDMO Market Trends #Pharmaceutical CDMO Market Analysis #Pharmaceutical CDMO Market Forecasts 11 views

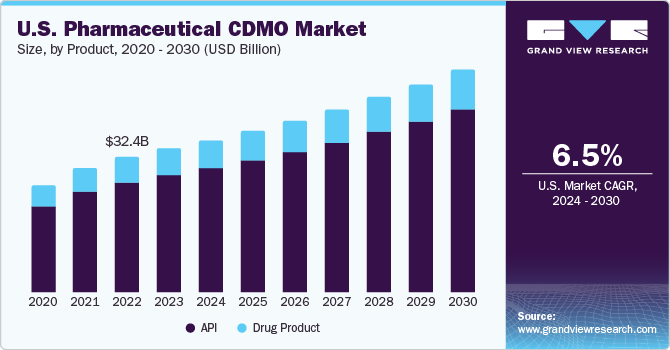

Pharmaceutical CDMO Market Growth & Trends

The global pharmaceutical CDMO market size is anticipated to reach USD 235.5 billion by 2030 and it is projected to grow at a CAGR of 7.2% from 2024 to 2030, according to a new report by Grand View Research, Inc. A growing consumption of biopharmaceuticals, rising demand for advanced therapeutics, demand for orphan drug discovery, upsurge number of clinical trials and increasing demand for one-stop-shop CDMOS are anticipated to influence the global market positively.

In addition, increasing pharmaceutical R&D investments can drive the market growth. As pharmaceutical companies invest more in R&D, they may seek external expertise and resources to accelerate drug development processes. CDMOs provide specialized services in drug development, manufacturing, and testing, making them valuable partners for pharmaceutical companies looking to outsource certain aspects of their R&D activities. Several players are investing in R&D activities of pharmaceuticals. For instance, in 2022, F. Hoffmann La Roche increased its R&D spending to USD 14.7 billion from USD 13.3 billion in the previous year. Another major player in pharmaceutical R&D expenditures for the same period was Merck & Co., allocating USD 13.5 billion to R&D. Janssen, the pharmaceutical arm of Johnson & Johnson, followed with an investment of USD 11.6 billion, slightly lower than the previous year's USD 11.9 billion.

Gather more insights about the market drivers, restrains and growth of the Pharmaceutical CDMO Market

Besides, increasing outsourcing services by pharmaceutical companies in the pharmaceutical industry has profoundly impacted the market. The trend of outsourcing activities in pharmaceutical domain is rising as companies find value in acquiring additional competencies essential for successful drug development & commercialization. Besides providing extended expertise & assisting in improved cash flow management, outsourcing brings significant manufacturing advantages, including reducing investment risks.

Notably, in the context of early-stage technologies and products, establishing expensive in-house capabilities entails substantial risks across product development phases. At the same time, outsourcing serves as a risk-averse alternative. In addition, having a limited understanding of the required scale for current & future product offerings or market penetration poses significant hurdles in designing and scaling manufacturing for in-house production. Consequently, the preference for outsourcing has grown as an effective strategy until market demand for products becomes well-established & understood.

Furthermore, the global distribution of clinical trials is expected to boost market growth. Clinical trials are executed globally, and their geographical distribution is shaped by diverse factors such as disease prevalence, regulatory conditions, population demographics, healthcare infrastructure, and cost considerations. As of February 2024, there is a discernible trend towards a more globalized approach to clinical trials. Over half of all registered studies are conducted outside the U.S. Meanwhile, over 35% of trials are exclusively conducted within the U.S. This emphasizes increasing international collaboration in collective pursuit of medical advancement.

Pharmaceutical CDMO Market Report Highlights

- Based on product, the active pharmaceutical ingredient (API) segment led the market with the largest revenue share of 81.20% in 2023. The segment growth is driven by competitive drug development and growing demand for end-to-end Contract Development & Manufacturing Organization (CDMO) services. In addition, advancements in API manufacturing, growth of the biopharmaceutical sector, and increasing geriatric population are some of the key factors propelling segment growth

- Based on the workflow, the commercial segment held the largest market share in 2023 attributed to robust demand for pharmaceutical products, such as biosimilar medications, generic medications, and regenerative therapies. This is where commercial CDMOs may help by providing knowledge, saving time, and being cost-effective

- Based on application, the oncology segment dominated the market with the largest revenue share of 21.82% in 2023. The segment is driven by an increasing number of cancer cases globally. In addition, increasing pharmaceutical R&D investments, patent expirations, and demand for oncology drugs & biologic innovations are the factors driving the oncology market

- Asia Pacific dominated the market with the revenue share of 37.64% in 2023. The presence of various factors, such as improved social insurance schemes & constantly improving economic conditions, which allow patients to pay out-of-pocket pharmaceutical costs is expected to drive market significantly

Pharmaceutical CDMO Market Segmentation

Grand View Research has segmented the pharmaceutical CDMO market report based on product, workflow, application, end-use, and region:

Pharmaceutical CDMO Product Outlook (Revenue, USD Million, 2018 - 2030)

- API

- Drug Product

Pharmaceutical CDMO Workflow Outlook (Revenue, USD Million, 2018 - 2030)

- Clinical

- Commercial

Pharmaceutical CDMO Application Outlook (Revenue, USD Million, 2018 - 2030)

- Oncology

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disease

- Metabolic Disorders

- Autoimmune Diseases

- Respiratory Diseases

- Ophthalmology

- Gastrointestinal Disorders

- Hormonal Disorders

- Hematological Disorders

- Others

Pharmaceutical CDMO End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Small Pharmaceutical Companies

- Medium Pharmaceutical Companies

- Large Pharmaceutical Companies

Order a free sample PDF of the Pharmaceutical CDMO Market Intelligence Study, published by Grand View Research.