Categories

Tags

-

#Aerospace 3D Printing Market Share

#Plant Growth Chambers Market Share

#Nurse Call Systems Market Size

#Cosmetic Dentistry Market Size & Share

#Plant Growth Chambers Market Size

#Packaged Coconut Water Market Share

#Heparin Market Size

#Burn Care Market share

#3D Printing Market Size

#3D Printing Market Trends

#Cosmetics Market Size

#Cosmetics Market Share

#Cosmetics Market Trends

#Anti-Money Laundering (AML) Software Market

#Chemoinformatics Market Size

#Global Eggshell Membrane Market Size

#Audio DSP Market Share

#Pasta Sauce Market share

#Medical Tourism Market Size

#Offshore Support Vessels Industry Overview

#Workwear Market Size

#Autoinjector Market Size

#Autoinjector Market Share

#Autoinjector Market Trends

#Pharmaceutical Filtration Market Share

#Wallpaper Market Share

#South Korea API Market Outlook: Digital Integration

#South Korea Forage Market Size

#South Korea Forage Market share

#South Korea Forage Market Trends

#Battery Electrolyte Market Size

#South Korea Advertising Market Outlook

#South Korea Advertising Market share

#South Korea Advertising Market growth

#Plant Growth Chambers Market Trends

#Cosmetic Dentistry Market 2025: Size

#Cosmetic Dentistry Market Trends

#Rhinoplasty Market share

#Rhinoplasty Market size

#Rhinoplasty Market Trends

#Dietary Fiber Market Size

#South Korea Drones Market Report

#South Korea Drones Market share

#South Korea Drones Market Trends

#Marine Plywood Market Size

#Marine Plywood Market Share

#Marine Plywood Market Trends

#Structural Core Materials Market Size

#Recommendation Engine Market Share

#Coconut Water Market Size

#Coconut Water Market Trends

#South Korea Electric Vehicle Market share

#South Korea Electric Vehicle Market Report 2025–2033: Size

#South Korea Electric Vehicle Market Trends

#Microgreens Market Size

#Microgreens Market Share

#Microgreens Market Trends

#Global Mezcal Market Size

#Cotton Yarn Market Size

#Global Virtual Data Room Market share

#Global Virtual Data Room Market size

#Global Virtual Data Room Market Trends

#Sustainable Athleisure Market Size

#Sustainable Athleisure Market share

#Sustainable Athleisure Market Trends

#Coffee Roaster Market Analysis

#Coffee Roaster Market share

#Coffee Roaster Market size

#High-End Lighting Market share

#High-End Lighting Market Size

#High-End Lighting Market Trends

#Fire Alarm and Detection System Market Size

#Fire Alarm and Detection System Market share

#Fire Alarm and Detection System Market Trends

#Lung Cancer Therapeutics Market Size

#Lung Cancer Therapeutics Market share

#Lung Cancer Therapeutics Market Trends

#3D printing materials market Size

#3D printing materials market share

#3D printing materials market Trends

#Cashew Milk Market Size

#Cashew Milk Market share

#Cashew Milk Market Trends

#jewellery market share

#jewellery market size

#jewellery market Trends

#Energy Drinks Market share

#Energy Drinks Market size

#Energy Drinks Market Trends

Archives

Battery Electrolyte Market Size, Share, Industry Overview, Grow

-

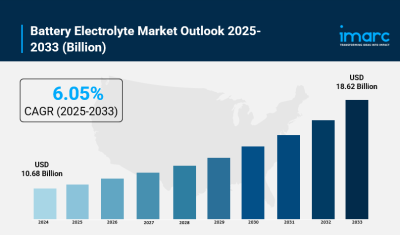

IMARC Group, a leading market research company, has recently released a report titled "Battery Electrolyte Market Size, Share, Trends and Forecast by Battery Type, Electrolyte Type, End User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global battery electrolyte market size, share, trends, growth and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Battery Electrolyte Market Overview:

The global battery electrolyte market was valued at USD 10.68 Billion in 2024 and is forecasted to reach USD 18.62 Billion by 2033, growing at a CAGR of 6.05% during the forecast period 2025-2033. The market is driven by rising demand for electric vehicles, consumer electronics, and energy storage products, particularly in Asia-Pacific, which held a 45% market share in 2024. Advances in electrolyte efficiency such as faster charging and enhanced safety, alongside developments in lithium-ion and solid-state battery technologies, are key growth drivers.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Battery Electrolyte Market Key Takeaways

- Current Market Size: USD 10.68 Billion in 2024

- CAGR: 6.05% during 2025-2033

- Forecast Period: 2025-2033

- Asia-Pacific dominates the market with a 45% share in 2024 due to strong manufacturing and EV adoption.

- Lithium-ion batteries led the market with 63.2% share in 2024, driven by demand for high-energy density batteries.

- The electric vehicle segment accounted for 52.8% of the market share in 2024, fueled by global shifts towards sustainable transportation.

- The US market is growing rapidly with over 1.3 million EV sales in 2023 and government incentives further driving demand.

- Innovations like FEST solid-state batteries and breakthroughs in lithium-ion battery lifespan are shaping market growth.

Request Your Free “Battery Electrolyte Market” Insights Sample PDF: https://www.imarcgroup.com/battery-electrolyte-market/requestsample

Market Growth Factors

The global battery electrolyte market drives from producing electric vehicles (EV) (14 million EVs sold globally in 2023) and from using consumer electronics increasingly (smartphone users expected to reach 4.88 billion in 2024), with requirements for lithium-ion batteries. Incentives like tax credits in the US plus subsidies throughout the Asia-Pacific region spur EV adoption, increasing demand. Electrolyte development gains encouragement from battery life, charge rates, and safety improvements.

Solid-state and lithium-ion battery technologies grow because of electrolytes. Stellantis and Factorial Energy announced the validation of FEST solid-state battery cells in April 2025. Those cells possess an energy density of 375Wh/kg and they charge rapidly. This reduces range anxiety and charging time thereby expanding the accessibility and affordability of EVs. At the same time, research into lithium-ion battery degradation improves the longevity and efficiency of the batteries. An example is the 2025 University of Colorado Boulder degeneration discovery. This allows longer-lasting electrolyte solutions to be developed.

The increased need for laptops, cameras, other electronic devices, and gaming consoles is a main cause for the market for lithium-ion batteries. Increasing sales in smart homes of vacuum cleaners, washing machines, home appliances, and other devices also propel the market for electrolytes. Apart from batteries for electric vehicles, battery electrolytes are also used in many batteries, such as alkaline zinc-manganese oxide batteries, in consumer electronics appliances. The battery electrolyte market is likewise expected to be driven by government-led green mobility initiatives worldwide.

Market Segmentation

Breakup by Battery Type:

- Lead Acid: Traditional rechargeable batteries commonly used in automotive and backup power systems.

- Lithium-ion: Dominant segment with 63.2% market share in 2024, favored for high energy density and lightweight in EVs and consumer electronics.

- Flow Battery: Specialized battery types for specific large-scale energy storage applications.

- Others: Includes emerging battery technologies beyond main categories.

Breakup by Electrolyte Type:

- Liquid Electrolyte: Comprising lithium salts in organic solvents, widely used for stable charge cycles in EVs and electronics; dominant but safety concerns persist.

- Solid Electrolyte: Gaining popularity for enhanced safety and thermal stability; key in solid-state batteries.

- Gel Electrolyte: Hybrid form that balances ionic conductivity and safety; used in flexible batteries and advanced energy storage.

- Sodium Chloride: Used in sodium-ion batteries, a cost-effective, abundant alternative to lithium-based electrolytes.

- Nitric Acid: Used in some lead-acid batteries, beneficial in industrial applications with high charge/discharge cycles.

- Sulphuric Acid: Essential in lead-acid batteries for ion exchange; widely used in automotive and backup applications.

- Others: Encompasses ionic liquids, polymer electrolytes, and alternative materials for advanced battery technologies.

Breakup by End User:

- Electric Vehicle: Largest segment with 52.8% share in 2024; demand driven by EV adoption and related government policies.

- Energy Storage: Applications in renewable energy and grid storage solutions.

- Consumer Electronics: Batteries for smartphones, laptops, cameras, and wearables.

- Others: Various additional applications beyond main sectors.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific leads the battery electrolyte market with a 45% share in 2024, attributed to strong manufacturing bases, rapid electric vehicle adoption, and substantial investments in renewable energy. Key countries include China, Japan, and South Korea, which are significant players in battery production. The region benefits from government incentives and a growing focus on sustainable energy, making it pivotal for market expansion.

Recent Developments & News

- May 2025: FEV and Mahindra co-developed an LFP battery system with advanced electrolytes, enabling 20%-80% charging in 20 minutes for Mahindra’s Electric Origin SUV.

- April 2025: Toshiba released SCiB lithium-ion battery modules with enhanced heat dissipation and longer life, used in EV buses and ships.

- March 2025: Lohum launched India’s first battery-grade lithium refinery with 1,000 metric tons annual capacity and high lithium purity.

- February 2025: Duracell partnered with Satya International for manufacturing and distributing Duracell batteries in Asia and Africa, focusing on improved electrolyte formulations.

- February 2025: Luminous Power Technologies opened a new lead-acid battery unit in Uttarakhand incorporating advanced electrolyte systems and sustainable practices.

Key Players

- 3M Company

- American Elements

- BASF SE

- GS Yuasa International Ltd.

- Guangzhou Tinci Materials Technology Co. Ltd.

- Johnson Controls

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Shenzhen Capchem Technology Co. Ltd.

- Targray

- Ube Industries Ltd.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=4800&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No:

+91 120 433 0800,

+91 120 433 0800,United States: +1-201971-6302